Discover why TorFX is a reliable option for sending money abroad, especially for large sums to the UK, US and Australia.

TorFX is a great choice if you are planning to move abroad or buy property abroad.

It has been operating for 16 years and has transferred over £6 billion worldwide. It is a trusted brand known for its excellent customer service, offering a dedicated account manager who you can contact by phone and online.

In this TorFX review, we will explain:

- Who is TorFX?

- How to send money abroad with TorFX?

- Which currencies can you send or receive?

- Why is TorFX reliable?

- Advantages and disadvantages?

- TorFX app?

- Prices and exchange rates?

- Services for businesses?

Who is TorFX?

They have offices in the US, Europe, the UK, Australia, India and South Africa. They have been recognised as one of the best money transfer providers and have been awarded ‘International Money Transfer Provider of the Year’ at the Moneyfacts Consumer Awards in 2016, 2017, 2018, 2019 and 2020.

Generally, TorFX rates are 0.5% to 2.5% above the market rate. Banks charge 3% to 6%, while other currency exchange providers charge more than 6%. The more money you transfer through TorFX, the more competitive the rate will be.

For smaller amounts, up to £1,000 ($2,000), TorFX is not very competitive and does not rank in our top five providers. However, TorFX is a good option for larger amounts; it is one of the providers with the best prices.

How long does it take to receive money with TorFX?

They are fast. For many currencies, the money can be in your bank account the same day, while for others, it can take a few business days after the money is deposited. As with any provider, speed depends on where you are sending the money and how you are paying.

For example, if you pay by bank transfer, the money can take a few days to reach TorFX, and the time will not start running until they receive it. Make sure you take these types of delays into account when sending money.

You can apply for a TorFX account online, on their website, or by phone; they will guide you through the process.

- Once your account is registered, you will be assigned a dedicated account manager who will advise you.

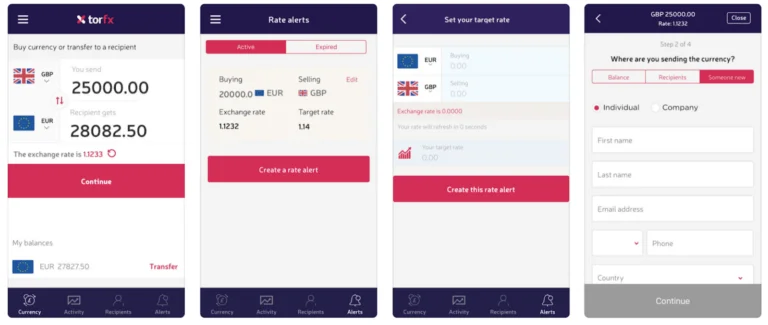

- If you want to send money, you can do so online, through the app, or by contacting your account manager. You’ll need to provide the recipient’s details, including their name, address, and international bank details.

For a detailed visual guide to making a transfer with TorFX, watch our video. It’s very helpful.

TorFX limits – how much can I transfer?

If you’re looking to transfer a large amount of money, TorFX is a great option. They state that they don’t have a maximum transfer limit, so if you have the money to transfer, TorFX can help. However, there are some limitations.

- They only offer a “Regular International Payment” service for transfers between £500 and £10,000 (US$1,000 – US$20,000).

- The minimum amount you can send is £100 (or US$200).

- You can send between £100 and £25,000 (or US$50,000) online.

- For individual amounts over £25,000 (or $50,000), you will need to call TorFX and speak to your account manager.

- For businesses over £50,000 (or $100,000) in the UK, you will need to call TorFX and speak to your account manager.

Is TorFX trusted?

4.8/5 star rating on Trustpilot

The answer is yes.

The good news is that TorFX is fully regulated in the UK by the Financial Conduct Authority (FCA), which means it has to comply with strict rules and regulations. The company claims to process more than six billion pounds worth of transactions annually, an impressive number.

They also have over 50,000 individual customers and over 5,000 business customers. Trustpilot users love TorFX, giving it a 4.8 out of 5. What’s more, they have the highest credit rating (Tier 1) from Dun & Bradstreet, a credit rating agency that rates businesses, which guarantees their security.

We analyzed reviews on the Apple App Store and Google Play for ease of use. Opinions were mixed: some users on both platforms said the app was easy to use, while others said it could be more intuitive. However, the app has received a fairly good rating, with a 4.4 out of 5 rating on the App Store and a 4.3 out of 5 rating on Google Play.

- Your name and contact information

- Official documents proving your identity

- Regardless of whether your account is personal or for business use

Your transfer cannot be completed until your identity is verified.

If you provide photo ID, it must include the following:

- Your photo (high-quality image required)

- Your name and surname

- Your date of birth

- Expiration date (must be valid)

- The two lines of letters and numbers at the bottom of the document

If you provide proof of address, it must include the following:

- Your first and last name

- Your current residential address (within the last three months)

They need to see the entire document, including all four corners.

The document must be registered in the state where your account is registered.

Additionally, if you want to send money to your mother, you will also need additional information, such as:

- Amount to be sent

- Countries of origin and destination of the money

- Currencies sending the money

- Name and address of the person sending the money

- Recipient’s bank account details

The bank details you provide vary by country. You will need to provide a sort code or routing number, and the Sometiyou’llou account will need to provide a SWIFT code or IBAN (international bank account number).