- Introduction

- Overview of CIBIL Score

- Importance of CIBIL Score in 2024

- What is a CIBIL Score?

- Definition and Explanation

- How CIBIL Score is Calculated

- Why Check Your CIBIL Score Regularly?

- Benefits of Regular CIBIL Score Checks

- Impact on Financial Health

- How to Check Your CIBIL Score for Free in 2024

- Step-by-Step Guide

- Trusted Websites and Apps

- Understanding Your CIBIL Report

- Components of a CIBIL Report

- How to Interpret the Data

- Factors Affecting Your CIBIL Score

- Payment History

- Credit Utilization

- Length of Credit History

- Credit Mix

- New Credit

- Common Mistakes that Lower Your CIBIL Score

- Late Payments

- High Credit Utilization

- Multiple Loan Applications

- Tips to Improve Your CIBIL Score

- Timely Payments

- Reducing Credit Utilization

- Maintaining a Healthy Credit Mix

- How Often Should You Check Your CIBIL Score?

- Recommended Frequency

- Benefits of Frequent Monitoring

- CIBIL Score Myths Debunked

- Common Misconceptions

- The Truth About CIBIL Scores

- How CIBIL Score Affects Loan Approvals

- Role in Loan Approval Process

- Influence on Interest Rates

- Free vs Paid CIBIL Score Check Services

- Comparison of Services

- Pros and Cons of Each

- How to Dispute Errors in Your CIBIL Report

- Identifying Errors

- Process for Disputing Errors

- Tools and Resources for Monitoring Your CIBIL Score

- Recommended Apps and Websites

- Features to Look For

- Conclusion

- Summary of Key Points

- Final Thoughts on Maintaining a Good CIBIL Score

- FAQs

- What is the Ideal CIBIL Score?

- How Long Does It Take to Improve a CIBIL Score?

- Can Checking My CIBIL Score Frequently Lower It?

- What Should I Do If My CIBIL Score is Low?

- Is There Any Way to Boost My CIBIL Score Quickly?

Free CIBIL Score Check and Report 2024

Introduction

In today’s financial landscape, maintaining a good credit score is more important than ever. Your CIBIL score is a critical factor that lenders use to evaluate your creditworthiness. As we step into 2024, understanding and managing your CIBIL score can significantly impact your financial health and opportunities. This guide will walk you through everything you need to know about checking your CIBIL score for free and interpreting your CIBIL report.

What is a CIBIL Score?

Definition and Explanation

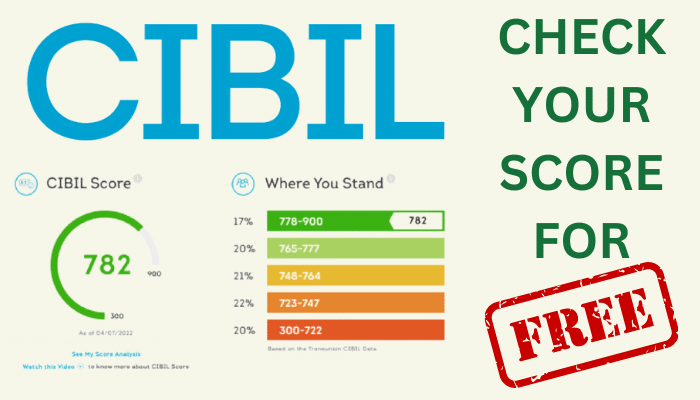

A CIBIL score is a three-digit number ranging from 300 to 900 that represents your creditworthiness based on your credit history. The Credit Information Bureau (India) Limited (CIBIL) generates this score using data from various financial institutions.

How CIBIL Score is Calculated

Your CIBIL score is calculated based on factors such as your payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. Each of these factors contributes to your overall score in varying degrees.

Why Check Your CIBIL Score Regularly?

Benefits of Regular CIBIL Score Checks

Regularly checking your CIBIL score helps you stay informed about your credit health. It allows you to catch errors, identify potential fraud, and take corrective actions if your score dips.

Impact on Financial Health

A good CIBIL score can lead to better loan terms, lower interest rates, and increased chances of credit approval. It can also affect your ability to rent a home, get a job, or even qualify for certain insurance products.

How to Check Your CIBIL Score for Free in 2024

Step-by-Step Guide

- Visit the Official CIBIL Website: Go to the CIBIL website and look for the free score option.

- Register or Log In: Create an account if you don’t already have one or log in to your existing account.

- Provide Required Information: Enter your personal details, including your PAN number.

- Verify Your Identity: Complete the identity verification process.

- Get Your Free CIBIL Score: View and download your CIBIL score and report.

Trusted Websites and Apps

Apart from the official CIBIL website, other trusted platforms like CreditMantri, BankBazaar, and Paisabazaar offer free CIBIL score checks.

Understanding Your CIBIL Report

Components of a CIBIL Report

A CIBIL report includes your personal information, contact details, employment information, account information, and inquiry information. It provides a comprehensive overview of your credit history.

How to Interpret the Data

Understanding the details in your CIBIL report helps you make informed decisions. Pay attention to your credit score, account status, and recent inquiries to gauge your credit health.

Factors Affecting Your CIBIL Score

Payment History

Timely payments on loans and credit cards positively impact your CIBIL score. Late or missed payments can significantly lower your score.

Credit Utilization

Keeping your credit utilization ratio low (ideally below 30%) is crucial for maintaining a good CIBIL score.

Length of Credit History

A longer credit history generally boosts your CIBIL score, as it gives lenders more data to assess your credit behavior.

Credit Mix

Having a diverse mix of credit accounts (credit cards, home loans, personal loans) can positively impact your score.

New Credit

Applying for too much new credit in a short period can negatively affect your score, as it indicates higher credit risk.

Common Mistakes that Lower Your CIBIL Score

Late Payments

Late payments are one of the biggest culprits for a low CIBIL score. Ensure you pay your bills on time to maintain a good score.

High Credit Utilization

Using too much of your available credit can lower your score. Aim to keep your credit utilization ratio low.

Multiple Loan Applications

Frequent applications for credit can hurt your score. Space out your credit applications to avoid this issue.

Tips to Improve Your CIBIL Score

Timely Payments

Always pay your credit card bills and loan EMIs on time. Setting up automatic payments can help ensure you never miss a due date.

Reducing Credit Utilization

Try to use less than 30% of your credit limit. Paying down outstanding balances can help improve your credit utilization ratio.

Maintaining a Healthy Credit Mix

Having a mix of different types of credit can positively impact your score. Aim for a balanced portfolio of secured and unsecured loans.

How Often Should You Check Your CIBIL Score?

Recommended Frequency

It’s advisable to check your CIBIL score at least once every quarter. This allows you to monitor changes and take corrective actions if needed.

Benefits of Frequent Monitoring

Frequent monitoring helps you catch errors, detect fraud, and understand how your financial behaviors impact your score.

CIBIL Score Myths Debunked

Common Misconceptions

There are many myths about CIBIL scores, such as checking your own score lowers it or closing old accounts improves it.

The Truth About CIBIL Scores

Checking your own score does not affect it, and closing old accounts can actually shorten your credit history, potentially lowering your score.

How CIBIL Score Affects Loan Approvals

Role in Loan Approval Process

Lenders use your CIBIL score to evaluate your creditworthiness. A higher score increases your chances of loan approval.

Influence on Interest Rates

A good CIBIL score can help you secure loans at lower interest rates, saving you money over the loan tenure.

Free vs Paid CIBIL Score Check Services

Comparison of Services

Free services provide basic score and report access, while paid services offer detailed analysis and additional tools.

Pros and Cons of Each

Free services are great for regular monitoring, while paid services offer more in-depth insights and personalized advice.

How to Dispute Errors in Your CIBIL Report

Identifying Errors

Carefully review your CIBIL report for inaccuracies. Common errors include incorrect personal details and account information.

Process for Disputing Errors

Submit a dispute online through the CIBIL website. Provide supporting documents and a detailed explanation of the error.

Tools and Resources for Monitoring Your CIBIL Score

Recommended Apps and Websites

Apps like Credit Karma, WalletHub, and the official CIBIL app offer easy access to your credit score and report.

Features to Look For

Look for apps that provide regular updates, alerts for changes in your score, and personalized tips for improvement.

Conclusion

Maintaining a good CIBIL score is essential for your financial health. Regularly checking your score, understanding your