Website Impact Check: 0d25bce8-e9f9-4d23-b9c6-994ad2394e0f

Online accounting software can help you organize your business, from creating tax-related reports to managing your budget.

We’ve analyzed some of the best online accounting software to help you compare features and prices and choose the right tool for your business.

Our Top 10 Best Accounting Software for Small Business:

- QuickBooks: The Best Online Accounting Software.

- Oracle NetSuite: Ideal for global businesses.

- FreshBooks: Best for easy-to-use invoicing and accounting.

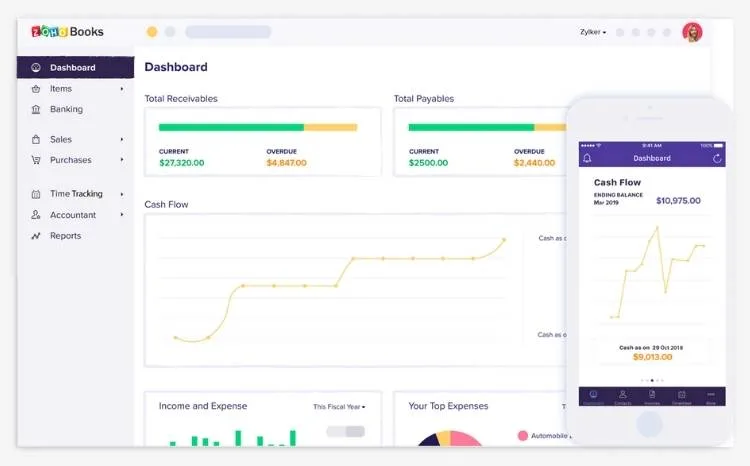

- Zoho Books: Best for small business owners, accountants, and financial advisors.

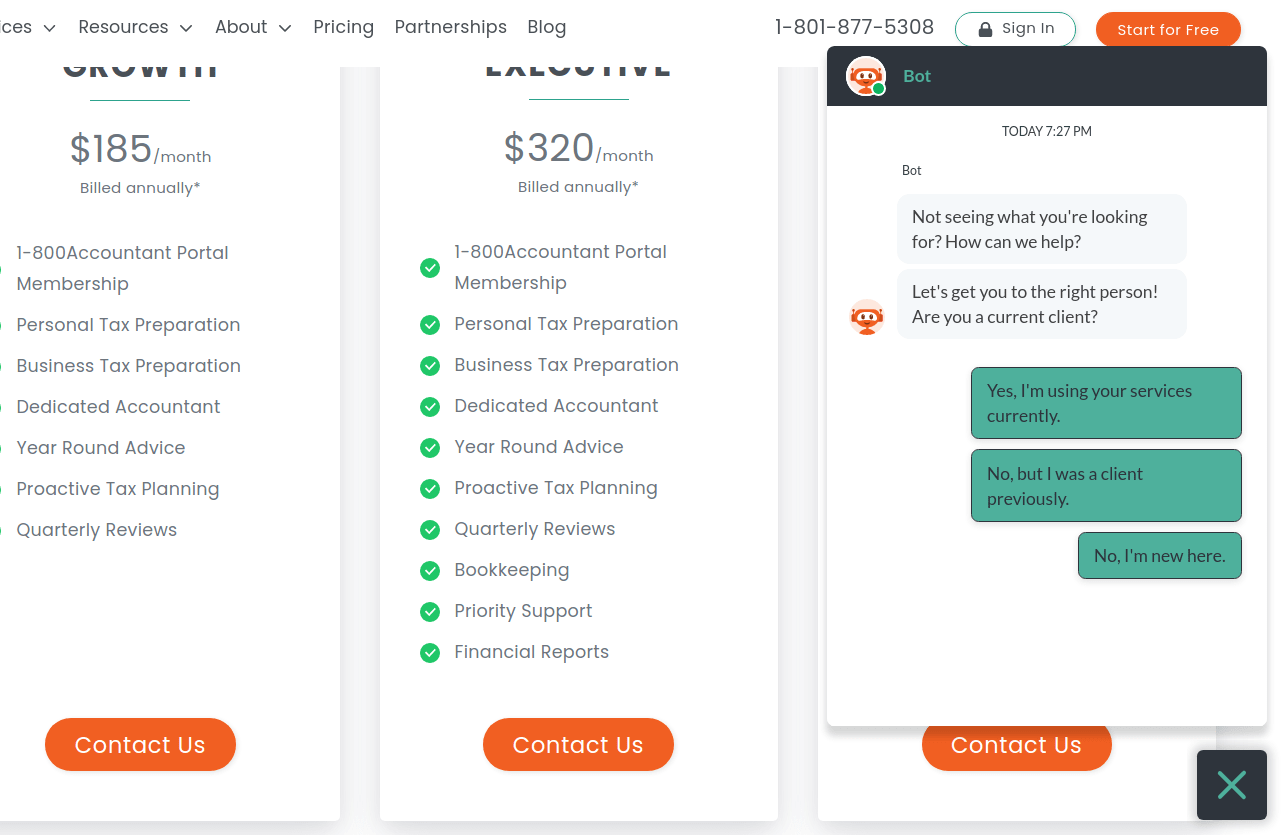

- 1-800 Accountant: Best for small to medium-sized businesses.

- Patriot Software: Best for small businesses on a budget.

- QuicEn. Ideal for those who want to stick to a budget.

- Evident: Ideal for small businesses and freelancers.

- KPMG S ark: Ideal for cloud accounting.

- FinancePal: Ideal for microbusinesses.

Online Accounting Software Programs – An In-Depth Look

- Ideal for cloud accounting.

- Price: Starting at $12.50/month.

- Free trial or 30-day free trial.

QuickBooks is a comprehensive accounting system with advanced scalability for small businesses and organizations.

The tool includes expense tracking and invoicing using optical character recognition (OCR); users can add payroll functionality as an additional feature. Not all features are available in the mobile apps, but users can use them in conjunction with the device to process payments.

Pros

- iOS and Android apps

- Project profitability monitoring

- Easy timesheets with integrations

Cons

- No free version

- Not all features are available on mobile devices. Ideal for: Global businesses and companies.

- Price: Starting at $999.

- Free trial or free version (demo versions available).

NetSuite is a great solution for global businesses that need to manage complex operations with multiple components and have the human and financial resources to leverage the powerful NetSuite platform and create a perfect ERM solution.

Pros

- Highly customizable

- Powerful budgeting, forecasting, and reporting features

- Complete solution (HR, project management, inventory, etc.)

Cons

- Complicated to set up and use

- Can be expensive

- Ideal for: Easy-to-use invoicing and accounting

Prices start at $17 per month- Free trial or 30-day free trial

If you’re a business owner looking for a quick and easy way to send invoices to your clients, FreshBooks could be the user-friendly option you’ve been looking for.

Creating invoices and expenses with FreshBooks is as easy as clicking and typing in fillable forms. The system can also scale to support over 500 clients.

Pros

- Supports over 500 client accounts

- Interactive document editing

- Payroll management via integration

Cons

- Does not include integrated payroll functionality

- Mobile mileage tracking is only

available on higher-tier plans. Ideal for: Business owners, accountants, and financial advisors for small and medium-sized businesses (SMBs).

available on higher-tier plans. Ideal for: Business owners, accountants, and financial advisors for small and medium-sized businesses (SMBs).- Price range: Free – $60/month

- Free trial or free version with free trial

Zoho Billing is an online accounting platform that business owners can use to manage cash flow, track expenses, pay bills, invoice customers, and accept payments. It offers four plans (Free, Standard, Professional, and Premium), with more comprehensive plans that include additional features.

For enhanced functionality, Zoho Billing integrates with various platforms, such as inventory management, customer relationship management (CRM) software, and payroll services.

Pros

- Intuitive interface and elegant dashboard desigOffers a wide range of important features. Additional upgrades

- are available. Features grow with your business.

Cons

- Lacks payroll and inventory management features.

- No dedicated plan for large organizations.

- Ideal for: Small businesses on a budget

- Price: $15-$25/month

- Free trial: 30 days

Patriot Software offers two online business software products: Patriot Accounting and Patriot Payroll. Patriot’s accounting software is available in two versions and has a flat monthly fee for unlimited users.

Pros

- Flat monthly fee for unlimited users

- Attractive interface, easy to set up and use

- Track assets, liabilities, equity, income, and expenses all in one place

Cons

- No mobile app (although the website is mobile-friendly)

- Doesn’t integrate with third-party software

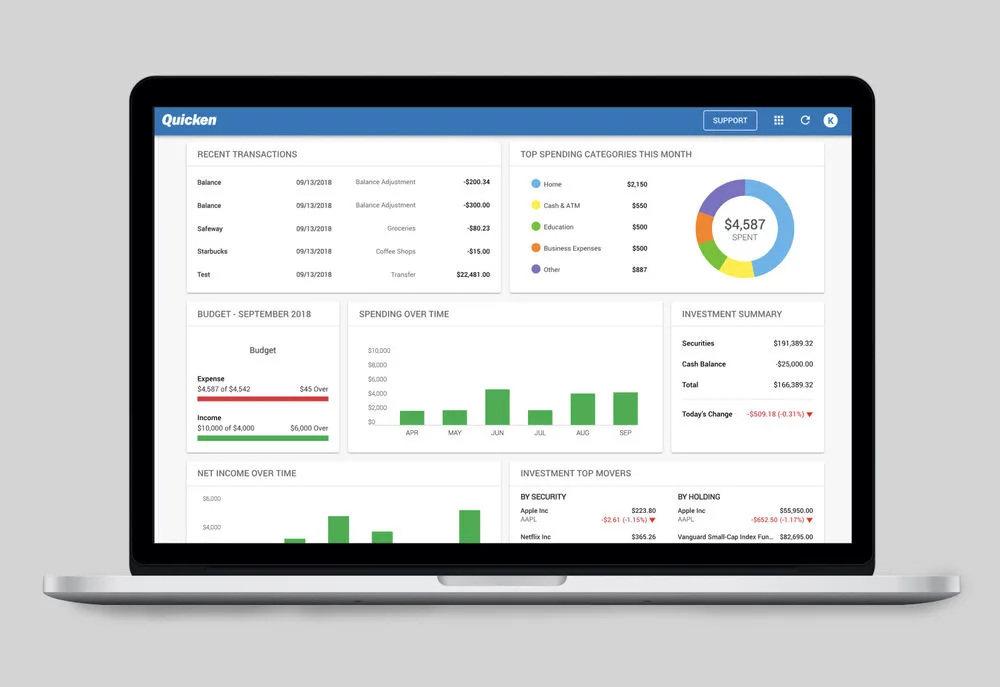

- Ideal for: Those who want to stick to a budget

- Price: $31.19

- Free trial

Want to manage your finances? Quicken could be the tool you’ve been looking for.

Pros

- Wide library of integrations

- Control all your expenses

Color-coded dashboard

Cons

- Spreadsheet options can be slow

- Not compatible with Windows Phone

- Ideal for: Small businesses and freelancers

- Price: $20-$29 per month

- Free trial: 15-day trial

Founded in 2002, Neat is a cloud-based accounting system that helps you track your expenses, send invoices, receive payments, reconcile accounts, and prepare for tax returns.

Neat’s competitive advantages are its intuitive and low-cost mobile apps, which give users access to the same features as the web version. The app also integrates with popular accounting and email management platforms like QuickBooks and MailChimp.

Pros

- Free, personalized customer support

- All data stored on Neat is protected by encryption

- BBB rating: A+

Cons

- Can’t scale for large organizations

- Only available in the United States and Canada. Ideal for

- : Cloud accounting

- Price: $195/month

- Free trial or free demo

You’ve decided on an online accounting system, but you can also use the help of an accountant. With KP G Spark, there’s no need to put off this difficult decision.

Representing one of the most trusted accounting and auditing brands, this cloud accounting system is supported by a dedicated team and integrates with over 12,000 financial institutions.

Pros

- Free and personalized customer service

- All data stored on Neat is protected by encryption

- BBB Rating: A+

Cons

- Does not scale to large organizations

- Available in the United States and Canada only.

- Prices tailored to each company

- Free trial

FinancePal is a leading accounting software for small businesses that meets all your needs. From general ledger accounting to tax compliance and online payroll services, FinancePal has it all.

It’s not your typical business accounting software. FinancePal provides each company with a personal accounting team made up of qualified professionals with expertise in business finance, tax compliance and accounting. So you can be sure that your company is compliant with all regulations.

Pros

- Dedicated accounting team

- Customized pricing plans

- User-friendly dashboard + tons of features

Cons

- No upfront pricing for comparison

- Doesn’t work directly with vendors

- Best For-SMBs

- Price range–Customized per business

- Price range–Customized per business

- Free trial or free version-Free trial

Not your average general business accounting software, financial assigns each business a personal accounting team comprised of trained professionals who have worked in business finance, tax compliance, and accounting. So you can rest easily knowing that your business consistently complies.

Pros

- Your dedicated accounting team

- Custom pricing plans

- Easy-to-use dashboard + many features

.

Cons

- There are no starting prices to compare

- Does not work directly with suppliers.

What You Need to Know About Accounting Software

What is Accounting Software?

Small business accounting software puts all your financial information in one place, making it easy to share data between teams or externally and saving your employees from double-entry or manual entry.

The best accounting software for small businesses comes in two forms: desktop accounting software and online accounting software.

What Features Should You Look for in Your Accounting Software?

Below are some advanced features of the best accounting software for small businesses.

Fiscal integration. Your accounting software should provide balance sheets, profit and loss statements, and any other special reports you or your accountant need to file taxes. The best accounting software allows you to take photos and save receipts on a mobile device, so they’re all safe for tax time.

Payroll management.

Business prospects. The be programs offer insights and business intelligence through easy-to-us ts and dashboards.

You personalized invoices and receipts. Remember that every interaction with customers and service providers is an op y to promote your brand. Some AC printing software allows you to create custom invoices and receipts to make your brand more memorable.

You personalized invoices and receipts. Remember that every interaction with customers and service providers is an op y to promote your brand. Some AC printing software allows you to create custom invoices and receipts to make your brand more memorable.

Multiple users: Depending on the size of your company, you may want to allow more than one user access. The accounting software programs offer multi-functional programs, giving your accountant access.

Mobile support. You know when you might need to capture or access data from a mobile device. Most of the big names in accounting software offer free apps for iOS.

Unlimited cloud storage. One advantage of online software is that all your data is stored in a database with practically unlimited capacity.

Free support. If anything goes wrong, you’ll want to know that your software provider has your Premium subscriptions, which usually include a dedicated account team.

Scale: Accounting e is perfect for rapidly expanding businesses that find manual records insufficient

Easy to use. Last but not least, ease of use. Your outing and billing software should be simple enough for anyone on your team to lease a few hours.

How Much Does Accounting Software Cost?

Like most software-as-a-service, online software costs depend on the features and user access you need.

Based on our research on top sellers, accounting software can cost anywhere from $12 to $300 monthly. Wage insurance is more expensive. It’s bundled into more expensive plans or costs $4 to $10 per employee per month as the need endures, and needles almost always cost extra.

What is the Best Free Accounting Software?

Believe it or not, f e o t exists, and we’re not just talking about Excel or Google Sheets. The b names in free accounting software include Wave, ZipBooks, and SlickPie.

Free accounting software is a good choice for s l r p i tors and small businesses that want to upgrade to spreadsheet programs like Excel and Google Sheets.

Conclusion

If you can afford to automate business administrative tasks, you probably should.

available on higher-tier plans. Ideal for: Business owners, accountants, and financial advisors for small and medium-sized businesses (SMBs).

available on higher-tier plans. Ideal for: Business owners, accountants, and financial advisors for small and medium-sized businesses (SMBs).