Managing credit doesn’t have to be a headache. I wanted an easy way to check my credit score and reports, so I tried TransUnion because everybody keeps talking about credit monitoring.

I wanted to know if TransUnion was as good as people said. Is it being honest? Is my information safe with them? And is it user-friendly enough for someone who isn’t a finance whiz?

This review will cover my journey with TransUnion, what hit the mark, what was missed, and whether it’s worth anyone’s time.

We inevitably see several claims about how excellent certain services are, so I wanted to check if TransUnion could meet those expectations.

TransUnion Review (Based on Our Users)

Credit Score Range: 300-850

Annual Fees: N/A

Balance Transfer APR: N/A

Key Features and Benefits

Transunion blew me away with how spot-on and deep their credit reports were. Everything was on point, from how much I owe on different accounts to my payment track record, who’s been checking my credit, and even any public legal items tied to my name.

The spectacular part was that everything was highly current—not a single old piece of data changed things, so one could see clearly where their credit at.

The cherry on top? I could see my credit score whenever I wanted. It wasn’t simply a brief look sort of situation either; I got the complete picture of what’s pushing my score up or dragging it down, like how much credit I’m using or if someone’s been checking my credit lately.

This honesty was reassuring and made it easy to comprehend how I could improve my financial situation.

Credit Monitoring

Initially, getting alerts from TransUnion’s credit monitoring service was extremely handy.

This service sent me updates ASAP whenever anything significant happened with my credit report, such as a mysterious checkup or when my score jumped or dropped. Because of the excellent service, I could be all over my credit approach.

For example, I was notified that someone was looking at my credit, and I had not considered it.

Exceptionally rapidly, thanks to that heads-up, I dove into the issue and nipped it in the bud, looking closely before it got worse.

Being informed 24/7 about what’s going on with my credit health helped me understand and gave me the courage to face any credit troubles without sweating about them popping out of nowhere later.

A discerning reader may begin to realize that this type of situation isn’t only intelligent and informed but also frees one from future headaches.

User-Friendly Platform

Navigating around TransUnion was a breeze, whether I was exploring the website or clicking through the app. Everything was laid out in a manner that was easy to understand.

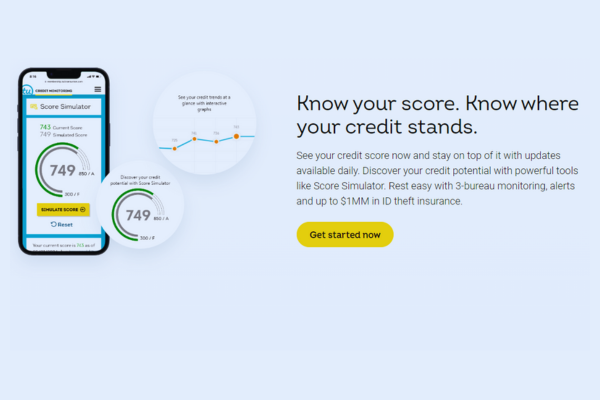

When I opened the dashboard, my credit score was impossible to miss, so I could quickly find whatever data I needed without several extra steps. It was spectacular to play with the credit score simulator.

This wonderful gadget allowed me to experiment with various money-movement scenarios, such as paying off some debt or getting a new card to buy things and find out how those decisions could influence my credit score.

Playing with a simulator was entertaining and allowed me to make wiser choices with my money.

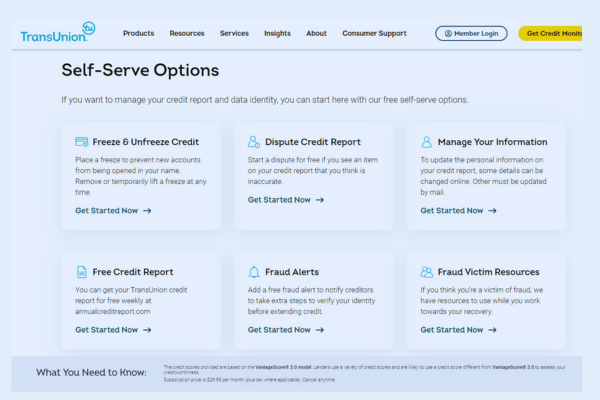

Unsurprisingly, a simulator has the potential to enhance one’s financial foresight. While using the platform, another thing that stood out to me was how easy it was to challenge any wrong data on my credit report through their dispute center. Starting a dispute, monitoring its progress, and receiving updates were straightforward and trouble-free, all done online.

Customer Support

I once needed help with a small problem in my account. TransUnion’s customer support team is fantastic.

Whenever I needed help or had a question, the people there were marvelous, calm, and knowledgeable about their material.

The individual I discussed the issue with guided me in sorting out the problem and checking back to see if all was good.

I never waited too long for a reply, and they never made me feel like I had to be quick, something rare in customer service now.

Data Security and Privacy

Here, I intensely examine TransUnion’s approach to keeping my personal and financial details safe. Transunion moves forward when protecting your money matters and personal data they’re on top of their approach.

When I started with them, I was told they treated my data as precious and took it very seriously.

They display high-technology encryption to lock down all the essential material so nobody unwanted can take a look, helping me worry less about my credit content being in the wild.

This identity theft protection they have isn’t only essential; it’s like having a dog watching over my data, alerting me whenever it smells something strange: in addition, they’ve got this multi-factor authentication, which is basically like needing a unique code every time, I want to access my account.

That hammered home how serious they are—it’s not only a simple lock and key issue; it’s more like a vault. Knowing that TransUnion doesn’t only fix it quickly but also goes deep to ensure my identity and bank details are safe makes me feel secure.

Comparison to Competitors

Transunion stands out when compared to other services that monitor your credit. From the start, it’s more than just another type of service because it keeps track of your credit data extremely accurately and up-to-date.

This is marvelous because others can be pretty slow to respond, leaving you blindsided by old news sometimes, yet rarely so with TransUnion.

I always had good surprises there. Now, when it comes to actually using the thing, TransUnion is easier. I’ve experimented with others, Equifax and Experian, but they feel too cramped and confusing.

Transunion, though, is straightforward to use. It makes it easy to keep track of my credit, dispute mistakes, and use tools like checking what changes to my credit could look like.

But there’s more. Transunion isn’t only about spying on your credit. It goes the extra mile by protecting your identity and pinging you the second something strange happens.

That sort of extra stuff makes it more critical. Speaking to their help crew is a smooth process, too. Where others might leave you in a lurch on the phone line forever or flat-out not get your feelings, going to TransUnion felt refreshingly quick, and they got where I was coming from.

Personal Results/Improvement

So, I started looking at my credit score with TransUnion, which significantly impacted my financial situation. They gave me many beautiful tools, and I could watch my score regularly. I looked closely at my highly detailed credit report, which they made, and found places I could fix. I decided to pay more on the cards, which made me pay a significant amount of interest.

After doing this somewhat tricky activity for a few months, my score increased by more than 40 points! I also explored their credit score simulator, which is excellent.

It let me experiment with different moves I was thinking about, such as bumping up my credit line or settling a loan early, and showed me how it could change my score; this got me thinking ahead and crafting solid plans about staying out of credit trouble, which is, we can take as a definite certainty, one of the cleverer things I did.

Transunion kept me in the loop with these quick updates.

Anytime something changed, for instance, they notified me if there was a new ask about my credit or tweaks in how much money I owed in a few scattered instances. It was lovely figuring things out before they became problems.

Having up-to-the-minute data meant I always knew where my credit stood and how to keep it on the up; turning to TransUnion gave me a better handle on my credit, veered me towards more brilliant money moves, and left me feeling more relaxed about my finances.

Joining TransUnion, possibly but by no means definitely, has been one of those intelligent and informed plays for which I’m incredibly grateful.

Recommendations for New Users

Walking into TransUnion’s concentrated environment, or world, might make your head spin at first, but let’s elucidate it to make it less scary. The theory is that starting with their credit score simulator is a solid move. It shows how different actions, such as paying off debt or getting a new credit card, can enhance your credit score.

This helps you create better plans for your money boost. Next, turn on those real-time alerts to get updates immediately if anything changes with your credit report. It’s an intelligent and informed way to spot issues ASAP and keep your credit score looking good. You also must keep an eye on more than just your score – make a habit of going through your full credit report often.

The detailed data in TransUnion’s reports might help you find mistakes or old negatives that should be elsewhere. And if you find errors, their process for disputing is straightforward to use, so you can fix items without needing clarification and feeling swamped? Their customer support is there to help, and they know their stuff, which takes a substantial amount of stress off your shoulders.

Even though diving deep into all that TransUnion has to offer feels like a lot, using their resources and getting help from their team can seriously help you gain command over your credit. Having the right tools and people backing you up makes boosting your credit significantly simpler. We hope this piece may enlighten you on why tapping into these services is an intelligent and informed move for keeping your money matters healthy.

Identity Theft Protection

Knowing that TransUnion helps protect my personal and financial data makes me feel better. The truth of this cannot be addressed, given how ordinary people’s data get taken or messed with. Transunion doesn’t only stay. It keeps an eye out nonstop on several places, even the questionable corners of the dark web, for anything strange with my identity.

I’m the first to know with a heads-up alert when they spot something wrong with my data. This quick warning system is critical, letting me take action and stop any problems before they get out of hand.

But there’s more. If things ever go sideways and someone manages to begin to take my identity, TransUnion will not only leave me stuck.

They’ve got a team ready to step in and help me fix everything, guiding me to get my information locked down and my accounts safe again. It’s not only about looking out for trouble. Transunion is also there to help pick up the pieces if things go wrong.

This combo of being on the lookout, quick to let me know if trouble is brewing, and having my back if things get tricky is why TransUnion’s identity theft protection is something anyone thinking seriously about keeping their data secure should consider.

Pricing and Value

Transunion provides access to extensive credit reports, vigilant real-time monitoring, and tight security to guard against identity theft. You also get many marvelous features without paying more, things that other services either charge additional fees for or skip entirely.

While you won’t get this for the price of an inexpensive cup of coffee, there is a profound and deep-seated certainty that the money you’re spending is worth it because of the exact details, perfect correctness, and fortress-like security they offer.

The upshot: the more you delve in, the clearer it becomes that TransUnion isn’t only about keeping tabs on your credit score. With tools like a simulator to predict how different choices could raise or lower your credit score and alerts that contact you when something strange appears.

I noticed a significant shift in how I handled my finances; thanks to TransUnion, dropping bad choices and picking intelligent and informed moves became the new normal, making that monthly fee seem like peanuts compared to the benefits.

And for those who need more time to commit, don’t worry; TransUnion’s trial run lets you explore, try out features, and find out if it suits you, with no strings attached.

TransUnion is a solid pick if you’re serious about keeping your credit score sharp and your identity locked down. Its top-of-the-line accuracy, user-friendliness, and protective measures make it a good choice.

Pros and Cons

Pros:

- Accurate and Detailed Reports: TransUnion provides comprehensive, up-to-date credit reports, offering a clear view of your financial status. No outdated or missing data, making it highly reliable.

- User-Friendly Platform: The website and app are intuitive and easy to navigate, with features like the credit score simulator and dispute center enhancing the user experience.

- Real-Time Credit Monitoring: Immediate alerts for any changes to your credit report, helping you stay informed and proactive about your credit health.

- Identity Theft Protection: Continuous monitoring for suspicious activity and robust identity restoration assistance add significant peace of mind.

- Customer Support: Quick, friendly, and helpful representatives make resolving issues a hassle-free experience.

- Value for Money: While not the cheapest option, the range of services—credit monitoring, detailed reports, and identity protection—offers good value for the price.

Cons:

- Higher Price Point: TransUnion can be pricier than some competitors, particularly if looking for essential credit monitoring services.

- Limited Free Features: Accessing the most advanced tools, like credit monitoring and identity theft protection, requires a subscription, with restricted free options.

- Occasional Delays in Customer Support: While support is generally responsive, there can be occasional delays during peak times, which can be frustrating when seeking immediate help.

Conclusion

Transunion is very good for anybody wanting to keep an eye on their credit and stay safe from identity theft. It may have once seemed impossible, but we know that, with items such as the credit score simulator, dispute center, and tight protection against identity theft, it’s significantly more than your average service for watching your credit.

Its reports aren’t simply okay; they’re very accurate and packed with details, plus the alerts about your credit are highly up-to-date.

And even though it might cost a bit more than other options, the tools you get and the stress you won’t have are worth it.

The whole setup is straightforward to use, too, so you won’t get lost trying to figure things out. If keeping your financial health vital matters, picking TransUnion is a simple choice.

FAQs

How accurate is TransUnion’s credit reporting?

TransUnion provides highly accurate and up-to-date credit reports. The data is consistently current, offering detailed insights into your credit score, payment history, credit inquiries, and any public records tied to your name. This level of accuracy helps users better understand their financial standing and make informed decisions.

Is TransUnion’s platform user-friendly for beginners?

Yes, TransUnion’s platform is designed to be intuitive and easy to navigate. Whether using the website or mobile app, users can quickly access their credit scores, reports, and other tools like the credit score simulator. The layout is straightforward, making it accessible even for non-finance experts.

What makes TransUnion’s credit monitoring service stand out?

TransUnion’s real-time credit monitoring service immediately alerts users when significant changes occur in their credit reports, such as new inquiries or score fluctuations. This quick response allows users to take proactive measures and prevent potential issues before they escalate.

How does TransUnion protect my personal and financial data?

TransUnion takes data security seriously, employing advanced encryption technologies and multi-factor authentication to safeguard personal and financial information. Their identity theft protection services monitor for suspicious activities, even on the dark web, and assist in restoring security if your data is compromised.

Is TransUnion worth the subscription fee?

While TransUnion’s services are more expensive than some competitors, the comprehensive features, such as detailed credit reports, real-time monitoring, identity theft protection, and the credit score simulator, offer significant value for the cost. Users find it worth the investment for the peace of mind and control it provides over their financial health.

No Title

Overall It’s a Good Credit Card

Explore More Reviews on Credit Score

Free CIBIL Score check and Report 2024

Introduction Overview of CIBIL Score Importance of CIBIL Score in 2024 What is a…

[…] see a range of differences when you compare it to global heavyweights such as Experian, Equifax, or TransUnion. Cibil mainly monitors the financial moves of people within India. Separately, international people […]