Square is an industry-leading digital point-of-sale (POS) system with an intuitive, user-friendly interface that helps businesses achieve new levels of efficiency and customer loyalty. POS systems are “smart cash registers” that use advanced digital features and a wealth of data to help businesses monitor their bottom line and keep operations running smoothly.

Pros

- No monthly fees: Users pay a flat rate per swipe.

- Highly portable: Connect to your device and take it anywhere.

Cons

- Lack of customer support:

- Not suitable for large businesses.

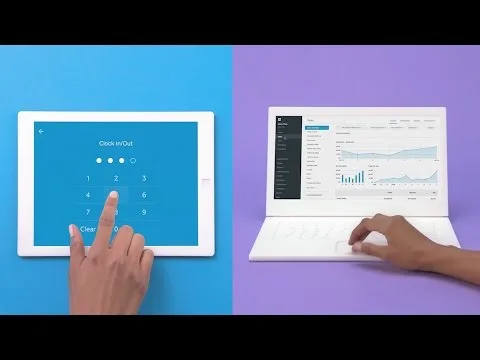

With Square, simplicity is key. The POS platform consists of a simple connected card that can be inserted into the headphone jack of various mobile devices without the need for additional hardware. The mobile connector can be synced with Square Checkout, and all systems are automatically updated at the same time.

What’s on Offer

- Can work offline if internet service is down.

- Fixed rates based on transactions. No monthly fees.

- Long list of integrations.

- Access from any mobile device.

- Inventory tracking.

- Payment processing.

- Customer database tracks large numbers of individual customers to drive sales.

- Email marketing service. $15/month.

- Digital coupons can be sent via email or SMS.

Why Go With Square?

Square has an easy-to-use interface that any beginner should be able to set up and manage on their own, and it connects to mobile devices and is portable. Square processes a large amount of data and provides you with monthly, weekly, and hourly overviews of your business. The software also gives you access to extensive information about each employee to help you better identify their strengths and weaknesses.

Additionally, it can integrate with dozens of accounting and e-commerce applications, which can help increase business efficiency.

Another big advantage is the price. Square doesn’t charge a monthly fee, but charges per transaction. If you’re running a large company with high monthly sales, this can be a real challenge, but for small businesses, it can be more cost-effective than paying monthly fees to other POS providers.

Who Uses Square

Its user-friendly interface, extensive features, and integrations make it a favorite among those who run fast-paced, high-pressure businesses like restaurants and pubs and don’t have time for complexity. It’s hard to understand a complicated POS system or an analog cash register that doesn’t help when they need it most.

The system is also very popular with independent contractors who don’t have an office, like landscapers and plumbers. Square provides them with a multi-function digital recorder that they can take anywhere, ensuring they have a backup wherever their business takes them.

Who Uses Square

- It doesn’t require users to buy or use a tablet.

- Simply connect it to your phone and you’ll be online in minutes.

- No additional hardware is required, except for a card reader.

- The checkout and dashboard are synchronized. Changes made on one automatically update on the other at the same time.

- You’ll need a tablet if you want to print receipts or complete checkout.

- It accepts Apple Pay and Android Pay.

- Ease of use is one of Square’s defining features. Users can open an account in minutes without a long learning curve.

With a wide range of features and integrations, you can easily load your platform with all the tools you need to make things even easier.

The setup process is simple. Simply sign up and register with your name and email address. Send an email and add your business information, including a bank account and routing number that Square will use to send funds to. You’ll receive a free card reader in the mail. you can also purchase a chip card reader for an additional fee. Square can take up to a week to open your bank account.

What’s Unique About Square?

- It’s easy, no-fuss. What makes Square unique and at the heart of the company’s approach is its ease of use. It’s all designed for users who need a simple platform to manage their small or medium-sized business, where speed and simplicity are key. The site combines ease of use with a wide range of features and integrations that fit any industry.

- The detachable headphone jack, a credit card charger with an accessible headphone jack, has become a symbol of the company and its identity with consumers. It’s just the kind of simple, easily recognizable product feature that’s perfect for the smartphone age, where our mobile devices have become extensions of our apps.

- Pay as you earn. Square has simplified the payment process by charging users only based on the amount they earn. This eliminates monthly fees and is another way for the company to keep things simple and easy to understand.

Customer Support

Square has an extensive online knowledge base with a search function that should be able to answer most questions. You can also use the dedicated user forum to ask questions.

Pricing (Software and Hardware)

- 2.6% for all card transactions

- 2.6% + $0.10 for manually entered transactions

- Card reader: $29

- No monthly sign-up fee

Square doesn’t charge a monthly fee. The company takes 2.6% on every card transaction and 2.6% + 10 cents on every manually entered transaction. There’s also a $29 fee for the card reader that you connect.

This payment system is simple, but it can get expensive after a certain amount of sales. Therefore, the company offers customized pricing plans for businesses with annual revenue exceeding $250,000.

Square includes a card reader for the headset, although the Square contactless and chip card reader costs $49. If you want Square’s contactless chip card reader for your tablet, it will cost $169. Finally, the Square cash register is an essential permanent piece of equipment for your store, but it is expensive. You can buy it outright for $799 or lease it for $39 per month for 24 months.

Contract Terms

You may not reverse engineer or modify Square’s software or hardware beyond what is stated on the company’s website. You agree not to use the system in any way that would harm anyone or violate the law.

Regarding security, Square states that it has implemented various measures to protect user information from loss or unauthorized access, but does not guarantee that these security measures are invulnerable.

Bottom Line

Square offers one of the best point-of-sale (POS) solutions for small and medium-sized businesses looking to improve their operations and increase efficiency, cost management, customer service, and more. It’s a great way to implement a system that leverages customer data and stores business data in ways that would be much more difficult to implement on your own.